The Travel Blog

How to Manage Travel Expenses with Budgeting Apps

Travelling the world is exciting—but dealing with travel costs can be stressful. Whether you’re planning a weekend getaway or a month-long journey, keeping track of your spending is vital to avoid unpleasant surprises.

The good news? Budgeting apps can simplify everything. This guide will show you how to master travel expense management, explore the best budgeting apps, and adopt proven strategies for trip cost tracking.

Pro Tip: Tracking your expenses from day one of your trip makes budgeting easier and prevents overspending.

Quick Guide: Why Use Budgeting Apps for Travel?

- Stay within your travel budget

- Monitor spending in real time

- Separate travel costs from daily expenses

- Set spending limits and get alerts

- Track expenses across currencies

Important: A budgeting app does not restrict your fun—it simply helps you spend with intention.

Step-by-Step: How to Manage Travel Finances on the Go

Step 1: Choose the Right Travel Budgeting App

Not all budgeting apps offer travel-specific features. Look for:

- Multi-currency support

- Easy manual or automated expense input

- Budget categories for flights, accommodation, food, transport, etc.

- Offline tracking

- Shared expense splitting for group trips

Check out our list of travel budget apps to keep your finances in check for recommended options.

Quick Tip: Download and test the app before your trip to get comfortable using it.

Step 2: Set a Travel Budget Before You Go

Estimate your costs in advance.

Include:

| Category | Example Costs |

| Flights | Airline tickets, taxes |

| Accommodation | Hotels, Airbnbs, hostels |

| Food | Restaurants, groceries |

| Activities | Tours, excursions |

| Transportation | Trains, buses, taxis |

| Emergency fund | Unexpected expenses |

Pro Tip: Always overestimate slightly to avoid running out of money mid-trip.

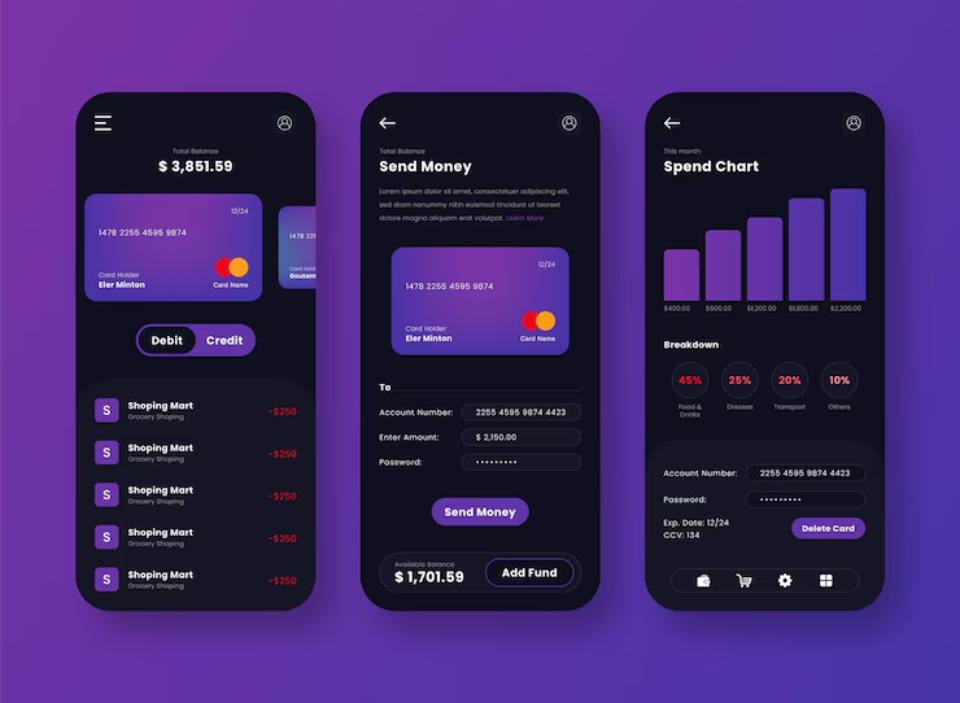

Step 3: Create Categories in Your Budgeting App

Organise your spending into helpful categories.

Examples:

- Flights

- Accommodation

- Food and drinks

- Entertainment

- Souvenirs

- Transport

- Tips and fees

Quick Tip: Some apps allow custom categories so you can personalise based on your trip.

Step 4: Track Every Expense

Input expenses as they happen.

- Save receipts for verification

- Add expenses immediately to avoid forgetting

- Use photo receipt uploads if the app supports it

Pro Tip: Consistency is key. A missed day can throw off your budget.

Step 5: Monitor Your Budget Daily

Most budgeting apps offer at-a-glance dashboards.

Check:

- How much you’ve spent so far

- How much remains in each category

- Any spending patterns that may be a problem

Quick Tip: Set up app notifications to alert you when you get close to your limits.

Step 6: Manage Group Travel Finances

Travelling with friends or family?

Look for apps with:

- Expense sharing features

- Bill splitting calculators

- Clear records of who owes what

Examples: Splitwise, Tricount.

Pro Tip: Record group expenses straight away to avoid disputes later.

Step 7: Analyse Your Spending Post-Trip

Once home:

- Review where you overspent or underspent

- Adjust future budgets based on real data

- Export expense reports for tax or reimbursement purposes

Quick Tip: Keeping a record of past trips helps you plan more accurately next time.

For practical advice, review our guide on managing travel expenses: tips for using budget apps effectively.

Additional Trip Cost Tracking Tips

| Tip | Benefit |

| Use cash envelopes for certain spending categories | Helps control impulse buys |

| Always carry backup payment methods | Avoids panic if cards fail |

| Download exchange rate apps | Stay informed on international costs |

| Back up your budget data | Prevents loss if you lose your phone |

| Stay disciplined | Small purchases add up quickly |

Common Mistakes to Avoid

| Mistake | Solution |

| Not setting a budget | Plan your spending before departure |

| Relying on one payment method | Bring alternatives |

| Forgetting to log expenses | Input costs immediately |

| Underestimating hidden fees | Always check fine print |

| Failing to check data roaming charges | Use offline-capable apps abroad |

Frequently Asked Questions

Are budgeting apps safe?

Reputable apps use bank-level security and data encryption. Always research before choosing.

Do budgeting apps work offline?

Many apps offer offline functionality. Sync data when you next connect to Wi-Fi.

Can I use one app for both travel and personal budgeting?

Yes. Some apps allow separate budgets or accounts for travel and everyday expenses.

Do apps work in multiple currencies?

Most travel budgeting apps convert automatically, but check if manual input is needed.

What if I lose my phone while travelling?

Keep backup paper records of key expenses and passwords. Most apps offer cloud backups.

Travel Smarter with Budgeting Apps

Using a budgeting app on your next trip will help you spend wisely and track every penny without stress. By embracing travel expense management, exploring the best budgeting apps, and applying consistent trip cost tracking habits, you’ll return home with great memories and a happy bank balance.

Plan smart. Spend wisely. Enjoy your trip with full financial control.